Teenage Car Insurance: Discounts and Coverage

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

UPDATED: Sep 16, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 16, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

If you have a teenage driver that has just received his or her driver’s license, it can be an exciting but worrisome time. It can also be an eye-opening experience when you call your insurance company and discover the quote for your teenager’s car insurance is high.

However, following a few pointers can reduce your cost of insuring your young driver and teach your teen the best safe driving habits for the road ahead.

Teenage Car Insurance Policies

Insurance for young drivers can be expensive and will increase your car insurance payments because young drivers are a high-risk group when it comes to calculating car insurance rates.

According to the National Highway Traffic Safety Administration, for both men and women, drivers aged 16 to 19 years of age have the highest average annual crash and traffic violation rates of any other age group.

Some of the reasons cited for this were:

- Poor hazard detection

- Carrying passengers

- Not wearing seat belts

In order to reduce the risk of young drivers causing accidents, most states have laws that restrict young drivers to a learner’s permit or provisional license.

These restrictions, generally based on age and how long the driver has had their permit or license, require minimum amounts of supervised driving, set limits on passengers, restrict hours of driving, and dictate when and where teenagers are permitted to drive.

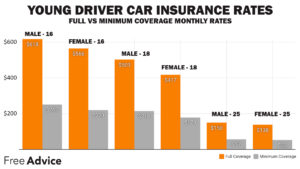

New drivers from ages 16 to 24 pay the highest for auto insurance of all age groups. Once a driver turns 25 years old and has a clean driving record, they will see their rates decrease drastically. Take a look at the graphic for a comparison between ages and gender.

Once a driver has a few years of experience on the road without any accidents or tickets, rates are much more affordable.

KEEP IN MIND: Insurance companies recognize the high risk involved with teenage drivers! This is why they charge higher prices for teenage car insurance policies.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Finding Teenager Car Insurance Discounts

There are some key car insurance discounts you can take advantage of to reduce your teenager’s car insurance.

Make a call to your insurance company and see if you can take advantage of the following:

- Driver’s education courses: Insurers may reduce the young driver’s rates by 15% for teenagers who complete a driver’s education class. Some companies will also offer a safe driving course that your teen driver can take online. You will also find that some car insurance agents will ask for your permission to speak to your young driver about the need for responsible safe driving habits. This conversation will help to reinforce those safe driving habits needed.

- Good student discounts: Young drivers with good grades can reduce premiums up to 25%. Many companies offer what is known as Good Student Discounts. Generally, if your teen driver maintains a B average or better, they will receive a discount on their premium price.

- Safe driving records: By avoiding traffic tickets and accidents, your teenager can establish a driving history and help reduce your insurance payments.

KEEP IN MIND: These discounts remain as long as your teen driver is accident or ticket free. Incurring a ticket or having an accident may cause your young driver to not only lose these discounts but they could incur a surcharge for the ticket or accident.

Other Ways to Save on Teenage Car Insurance

In addition to the available discounts, you can work with your car insurance company to reduce your premium payments by taking a close look at your policy. Consider doing the following:

- Find out how your insurer assigns drivers to vehicles. Many insurers automatically assign the highest-risk driver (in this case, the young driver) to the most expensive vehicle – even if the young driver never gets into that vehicle. If that’s your insurer’s policy, your rates may skyrocket. If your insurance company engages in this practice, consider shopping for a more favorable policy.

- Drive older cars. Older cars may not need comprehensive or collision coverage. Eliminating or reducing these may save you big money in premium costs.

- Reduce liability coverage levels. This is certainly an option that may save you money, but it might not be worth the risk. Reducing liability coverage could mean disaster – especially if you have other assets, such as a home or business. A serious accident could put those assets at risk if damages exceed your liability amounts. Also note that you can only reduce your liability coverage to the state minimum requirements, so the savings may not be significant enough to justify the risk.

Teenagers and Cars: Purchasing a Car and Insurance More Than One Young Driver

Are you considering purchasing a car for your teen? Giving a young driver their own car to drive can increase your car insurance premiums. If you want to purchase a car for your teenager, consider purchasing an older car to reduce your insurance payments.

TIP: Cheaper vehicles might not always be the best vehicles for a young driver. Read up on safety ratings and crash tests for the vehicle. Knowing your teenage driver is in a safe vehicle can give you peace of mind and save you money.

If you have two or more young drivers in your household that share a vehicle, this can increase your car insurance premium. Auto Insurance companies usually only assign one driver to one particular car, so if two or more young drivers in your household truly share one car you should choose the least expensive driver to be assigned to the car.

TIP: You can save money by choosing the less expensive young driver (usually a female or the driver with no violations) as the dedicated driver – main driver assigned to a car.

Buying teen auto insurance doesn’t have to put a dent in your pocket. Following the few tips above and asking the right questions about young driver discounts available, can save you money! To see how much you can save, click here to visit the free advice quote center and get a quote from several reputable companies.

For more information about getting the right car insurance policy to fit your needs, check out the following articles:

Click Here for a FREE car insurance quote today!

What Is Car Insurance and Why Should I Buy It?

Save Money When Buying Car Insurance with Online Quotes

Car Insurance Driver Discounts

Basic Types of Auto Insurance Coverage

What to Know About Car Insurance Agents Before You Buy

How to Fill Out an Online Car Insurance Quote

How Insurance Companies Calculate Your Car Insurance Rate

More Articles Redirect URLing A Variety Of Car Insurance Needs

Case Studies: Teenage Car Insurance Discounts and Coverage

Case Study 1: Utilizing Young Driver Discounts

Sarah, a parent of a teenage driver, seeks to reduce her car insurance premiums while providing adequate coverage for her young driver. After contacting her insurance company, Sarah discovers she can take advantage of multiple discounts, including good student discounts and safe driving discounts.

By ensuring her teenager maintains good grades and a clean driving record, Sarah significantly reduces the cost of insuring her young driver.

Case Study 2: Adding Safety Features to Reduce Premiums

John wants to provide the best protection for his teenage driver without breaking the bank. He decides to equip his teen’s car with additional safety features such as anti-lock brakes, airbags, and a tracking device. By making his teenager’s car safer, John qualifies for safety feature discounts, reducing his insurance premiums and ensuring his teen’s safety on the road.

Case Study 3: Sharing a Vehicle to Save on Premiums

Mary has two teenage drivers in her household who share a vehicle. To minimize insurance expenses, Mary designates the least expensive driver, based on age and driving history, as the primary driver for the shared car. This decision helps Mary save on premiums while ensuring both teenagers have access to a vehicle.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.