Cheap Chrysler Car Insurance in 2026 (Unlock Big Savings From These 10 Companies!)

The top picks for cheap Chrysler car insurance are Geico, American Family, and State Farm, with Geico offering the cheapest rate at $68 per month. These companies provide affordable and reliable coverage options, making them the top choices for Chrysler drivers looking to save on their car insurance premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

UPDATED: Sep 10, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 10, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage for Chrysler

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Chrysler

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, American Family, and State Farm are the best companies for cheap Chrysler car insurance. Geico offers the most affordable rate at $68 per month.

What types of car insurance coverage does Geico offer? Geico stands out for its extensive comprehensive coverage options and discounts, making it ideal for cost-conscious drivers who need cheap Chrysler insurance.

Our Top 10 Company Picks: Cheap Car Insurance for Chrysler| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $68 | A++ | Competitive Rates | Geico | |

| #2 | $70 | A | Costco Members | American Family | |

| #3 | $72 | B | Accident Forgiveness | State Farm | |

| #4 | $73 | A+ | Tailored Coverage | Farmers | |

| #5 | $75 | A+ | Vanishing Deductible | Nationwide |

| #6 | $76 | A+ | Snapshot Program | Progressive | |

| #7 | $78 | A++ | Bundling Policies | Travelers | |

| #8 | $80 | A | Affordable Rates | Safeco | |

| #9 | $81 | A+ | Customizable Coverage | Allstate | |

| #10 | $84 | A | Roadside Assistance | Liberty Mutual |

Keep reading to review these top providers and what they offer before you choose the most affordable Chrysler coverage.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

- Geico offers the cheapest Chrysler car insurance at just $68 per month

- American Family has cheap Chrysler coverage for Costco members

- Car insurance discounts for Chryslers can significantly lower your rates

#1 – Gieco: Top Overall Pick

Pros:

- Extensive Discounts: Offers numerous discounts for safe drivers and multi-vehicle Chrysler owners.

- Customizable Coverage: Provides flexible options such as comprehensive and collision coverage tailored for Chrysler vehicles.

- Competitive Rates: Geico flaunts its competitive rates for Chrysler insurance, demonstrating exceptional value for cost-conscious drivers, as presented in our Geico auto insurance review.

Cons:

- Limited Local Agents: Lack of local agents may limit personalized support for Chrysler policyholders.

- Specialized Coverage Gaps: Geico may not offer as many options for high-end or modified Chrysler models.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#2 – American Family: Best for Costco Members

Pros:

- Costco Members: American Family offers exclusive discounts for Costco members, providing tailored benefits for Chrysler drivers, as showcased in our American Family auto insurance review.

- Custom Coverage: Personalized coverage options, including accident forgiveness, tailored for Chrysler drivers.

- Loyalty Benefits: Offers discounts for long-term Chrysler policyholders and low-mileage drivers.

Cons:

- Fewer Discounts: Limited discount offerings for Chrysler drivers compared to other insurers like Geico or Progressive.

- Regional Availability: May not be available in all areas for Chrysler drivers seeking coverage.

#3 – State Farm: Best for Accident Forgiveness

Pros:

- Affordable Premiums: Chrysler car insurance starts at $72 per month, with bundling options.

- Accident Forgiveness: State Farm offers accident forgiveness, protecting Chrysler drivers from rate increases after their first accident, as displayed in our State Farm insurance review.

- Safe Driver Savings: Offers significant discounts for safe Chrysler drivers through the Drive Safe & Save program.

Cons:

- Limited Discounts: Fewer Chrysler-specific discounts compared to competitors like Geico.

- Premium Increases: Rates can increase significantly after a minor accident or claim involving a Chrysler.

#4 – Farmers: Best for Tailored Coverage

Pros:

- Strong Customer Service: Highly rated for personalized support for Chrysler car insurance policies.

- Safe Driver Discounts: Provides discounts for safe Chrysler drivers and multi-car policies.

- Tailored Coverage: Farmers exhibits tailored coverage options for Chrysler vehicles, highlighting its focus on personalized insurance solutions, as discussed in our Farmers insurance review.

Cons:

- Higher Premiums: Chrysler insurance premiums tend to be higher than competitors like Geico.

- Limited Discounts: Fewer available discounts for Chrysler-specific coverage compared to other companies.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros:

- Accident Forgiveness: Ideal for Chrysler drivers with a history of minor accidents.

- Vanishing Deductible: Nationwide’s vanishing deductible for Chrysler drivers reduces costs over time. To delve deeper, refer to our in-depth report titled “How do I renew my car insurance policy with Nationwide?“

- Affordable for Older Models: Offers competitive rates for older Chrysler vehicles.

Cons:

- Higher Rates: Premiums for newer Chrysler models are higher compared to cheaper options like Geico.

- Limited Add-ons: Fewer coverage add-ons available for Chrysler owners seeking specialized coverage.

#6 – Progressive: Best for Snapshot Program

Pros:

- Competitive Rates: Offers affordable Chrysler car insurance, especially for high-risk drivers.

- Online Tools: Extensive online services for easy policy management and claim tracking for Chrysler owners.

- Snapshot Programs: Progressive highlights its Snapshot program, offering savings for Chrysler drivers based on driving habits, as spotlighted in our Progressive insurance review.

Cons:

- Premium Increases: Rates may rise significantly after a claim involving a Chrysler vehicle.

- Slow Claims Process: Some Chrysler owners report delays during the claims process compared to competitors.

#7 – Travelers: Best for Bundling Policies

Pros:

- Bundling Policies: Travelers offers savings and convenience by bundling policies for Chrysler vehicles. For a comprehensive analysis, refer to our detailed guide titled “Does Travelers offer gap insurance?“

- Hybrid Vehicle Discounts: Discounts available for Chrysler drivers with hybrid or electric vehicles.

- Flexible Payment Options: Allows Chrysler owners to customize their payment plans for affordability.

Cons:

- Fewer Discounts: Lacks the variety of discounts for Chrysler drivers offered by competitors like Geico or State Farm.

- Average Customer Service: Service ratings may not meet the needs of some Chrysler owners seeking responsive support.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#8 – Safeco: Best for Affordable Rates

Pros:

- Comprehensive Add-ons: Offers optional coverage like custom parts and emergency assistance for Chrysler drivers.

- Affordable Rates: Safeco flaunts its affordable rates for Chrysler insurance, demonstrating a strong commitment to cost-effective coverage, as highlighted in our Safeco insurance review.

- High-Limit Coverage: Ideal for Chrysler owners needing extensive protection with high-limit policies.

Cons:

- Higher Premiums: Chrysler car insurance tends to be more expensive compared to competitors.

- Limited Local Agents: Fewer local agents available for personalized assistance with Chrysler policies.

#9 – Allstate: Best for Customizable Coverage

Pros:

- Drivewise Program: Offers discounts for safe Chrysler drivers based on driving habits.

- New Car Replacement: Ideal for Chrysler drivers with newer models needing replacement coverage.

- Customizable Coverage: Allstate offers customizable coverage options for Chrysler vehicles, tailoring policies to meet specific needs. as featured in our Allstate auto insurance review.

Cons:

- Higher Premiums: Allstate’s rates are higher than competitors like Geico for Chrysler insurance.

- Limited Discounts: Fewer available discounts for Chrysler drivers with older models.

#10 – Liberty Mutual: Best for Roadside Assistance

Pros:

- Roadside Assistance: Liberty Mutual offers reliable roadside assistance for Chrysler owners, highlighting its commitment to customer support. as shown in our Liberty Mutual auto insurance review.

- Specialized Discounts: Savings available for hybrid Chrysler vehicles and bundling policies.

- Comprehensive Coverage: Extensive options for Chrysler vehicles, including roadside assistance and gap insurance.

Cons:

- Higher Premiums: Liberty Mutual’s rates are higher for newer Chrysler models compared to other insurers.

- Limited Add-ons: Fewer specialized add-ons for Chrysler drivers with unique coverage needs.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Cheap Chrysler Car Insurance Monthly Rates by Provider & Coverage Level

When comparing cheap Chrysler car insurance, monthly rates vary significantly by provider and coverage level. Geico offers the lowest rates, while American Family and State Farm provide slightly higher premiums with more extensive coverage options.

Chrysler Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $81 | $155 |

| American Family | $70 | $146 |

| Farmers | $73 | $149 |

| Geico | $68 | $140 |

| Liberty Mutual | $84 | $160 |

| Nationwide | $75 | $148 |

| Progressive | $76 | $150 |

| Safeco | $80 | $154 |

| State Farm | $72 | $145 |

| Travelers | $78 | $152 |

Each provider tailors its pricing based on factors like liability, comprehensive, and collision coverage, allowing Chrysler drivers to find the most affordable and suitable plan.

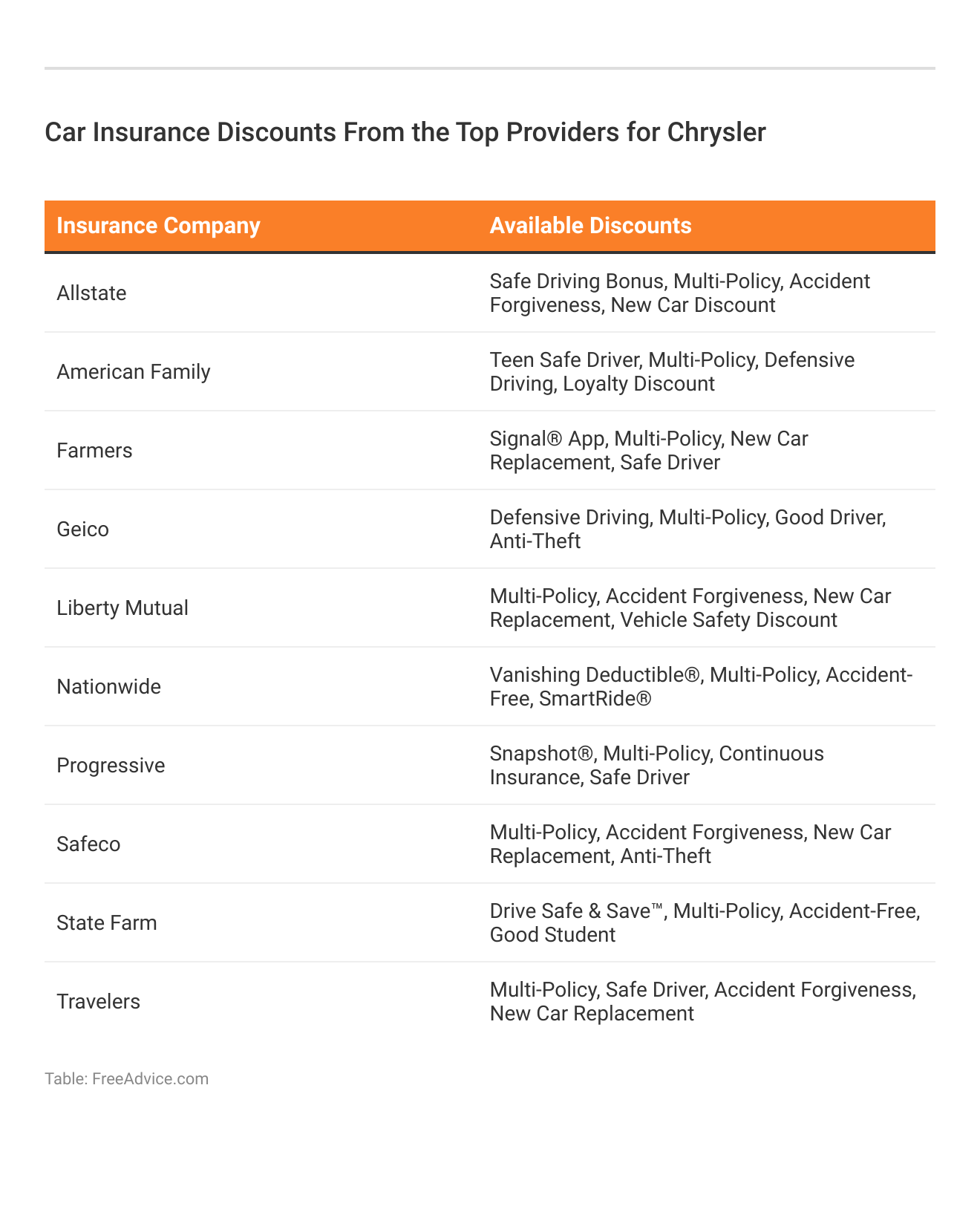

Car Insurance Discounts For Chrysler Vehicles

Frequently Asked Questions

At what age is car insurance cheapest?

Car insurance is typically cheapest for Chrysler drivers between the ages of 50 and 65, as insurers offer lower premiums for this age group seeking cheap Chrysler car insurance.

What is the lowest form of car insurance?

The lowest form of cheap Chrysler car insurance is liability-only coverage, which meets the minimum legal requirements without covering damages to your Chrysler vehicle.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

What’s the cheapest car insurance to go with?

Geico typically offers the cheapest car insurance for Chrysler drivers, providing competitive rates and discounts tailored to cheap Chrysler car insurance. To delve deeper, refer to our in-depth report titled “types of car insurance coverage that Geico offers”

What is zero car insurance?

Zero car insurance refers to no-claims bonus coverage, which allows Chrysler drivers to lower their premiums for cheap Chrysler car insurance by avoiding claims over a period of time.

At what age is car insurance most expensive?

Car insurance is most expensive for Chrysler drivers under 25, as younger drivers face higher premiums when seeking cheap Chrysler car insurance.

Which category is cheapest to insure?

Chrysler sedans, like the Chrysler 200, fall into the cheapest insurance category, making them an affordable option for those looking for cheap Chrysler car insurance.

What type of insurance is most important for cars?

Comprehensive coverage is the most important type of insurance for protecting your Chrysler, ensuring that damages from various risks are covered alongside cheap Chrysler car insurance.

Which cars are least expensive to insure?

Chrysler sedans and smaller models are among the least expensive to insure, making them ideal for drivers searching for cheap Chrysler car insurance.

What is the cheapest auto insurance for seniors?

Geico offers some of the most affordable car insurance rates for senior Chrysler drivers, providing excellent options for cheap Chrysler car insurance. To expand your knowledge, refer to our comprehensive handbook titled “average auto insurance rates by age and gender”

What is the cheapest insurance for one accident?

Geico is often the cheapest option for Chrysler drivers with one accident on their record, offering affordable rates for cheap Chrysler car insurance even after an incident.

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.