Cheap Car Insurance in Oregon for 2026 (Earn Savings With These 10 Companies)

State Farm, Progressive, and Geico are the top providers for cheap car insurance in Oregon, with rates starting as low as $38 per month. These providers offer safe driver discounts, usage-based savings, and value through bundling discounts. Each company offers tailored coverage to meet the needs of Oregon drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

UPDATED: Sep 24, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 24, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Oregon

A.M. Best Rating

Complaint Level

19,116 reviews

19,116 reviewsAre you a driver in Oregon looking for affordable car insurance? You’re not alone. Car insurance is a necessary expense, but that doesn’t mean you have to break the bank to be properly insured.

Our Top 10 Company Picks: Cheap Car Insurance in Oregon| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $38 | B | Local Agent | State Farm | |

| #2 | $39 | A+ | Flexible Coverage | Progressive | |

| #3 | $47 | A++ | Affordable Rates | Geico | |

| #4 | $49 | A++ | Competitive Rates | Travelers | |

| #5 | $50 | A+ | Experienced Drivers | The Hartford |

| #6 | $54 | A | Customer Service | American Family | |

| #7 | $56 | A+ | SmartRide Program | Nationwide |

| #8 | $57 | A+ | Comprehensive Discounts | Farmers | |

| #9 | $71 | A | Tailored Coverage | Liberty Mutual |

| #10 | $78 | A+ | Claims Service | Allstate |

In this article, we will explore the various aspects of cheap car insurance in Oregon, including the basics of car insurance, Oregon’s car insurance requirements, factors that influence car insurance rates, and tips on finding the best rates from top providers. Enter your ZIP code.

- State Farm, Progressive, and Geico offer rates starting at $38 per month

- Discounts include safe driver, usage-based, and bundling options

- Each company provides tailored coverage for Oregon drivers

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers some of the lowest premiums for Cheap Car Insurance in Oregon, starting as low as $38 per month, making it an affordable option for many drivers. Check out our State Farm insurance review & ratings for more information.

- Excellent Customer Service: With a dedicated 24/7 helpline, State Farm ensures that policyholders can easily get assistance, which enhances the experience for those seeking Cheap Car Insurance in Oregon.

- Flexible Coverage Options: They provide a variety of coverage options tailored to meet the specific needs of Oregon drivers, helping them find the best fit for Cheap Car Insurance in Oregon.

Cons

- Limited Online Tools: While their customer service is strong, State Farm’s online tools for managing policies may not be as user-friendly as some competitors, which can be inconvenient for those seeking Cheap Car Insurance in Oregon.

- Higher Rates for Young Drivers: Younger drivers may face higher premiums compared to other companies, which can make finding Cheap Car Insurance in Oregon more challenging for them.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Coverage

Pros

- User-Friendly Online Platform: Progressive’s website allows easy management of policies and claims, making it a convenient choice for those seeking Cheap Car Insurance in Oregon. Learn more in our article titled “How do I appeal an car insurance claim with Progressive?” for more information.

- Diverse Discounts: They provide a wide array of discounts, including those for safe driving and bundling, helping customers save significantly on their Cheap Car Insurance in Oregon.

- Innovative Usage-Based Insurance: Progressive’s Snapshot program rewards drivers for safe habits, allowing them to potentially lower their costs for Cheap Car Insurance in Oregon.

Cons

- Mixed Customer Service Reviews: Some customers report dissatisfaction with claims processing times, which can be a drawback for those looking for reliable support when buying Cheap Car Insurance in Oregon.

- Higher Initial Quotes: Initial quotes can be higher than expected, which may deter some customers from considering them for Cheap Car Insurance in Oregon.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums: Geico consistently ranks as one of the most affordable providers, making it an attractive option for Cheap Car Insurance in Oregon with rates as low as $38 per month.

- Extensive Discounts: With discounts for military members, good students, and safe drivers, Geico provides numerous ways to save on Cheap Car Insurance in Oregon. Read our Geico auto insurance review to learn more details.

- Customizable Coverage: Geico allows drivers to tailor their policies, ensuring they get the necessary coverage without overspending on Cheap Car Insurance in Oregon.

Cons

- Limited Local Agent Access: Geico primarily operates online, which might be a disadvantage for those who prefer face-to-face interactions when dealing with Cheap Car Insurance in Oregon.

- Complex Policy Details: Some customers find the policy details confusing, which can complicate understanding their options for Cheap Car Insurance in Oregon.

#4 – Travelers: Best for Competitive Rates

Pros

- Comprehensive Coverage Options: Travelers offers a wide variety of policies, making it easy for drivers to find suitable coverage for Cheap Car Insurance in Oregon. For those seeking cheap car insurance in California view our article titled “Bundling Home and Auto Insurance With Travelers”.

- Strong Discounts for Bundling: They provide substantial discounts when bundling auto with home insurance, enhancing affordability for Cheap Car Insurance in Oregon.

- User-Friendly Online Tools: Their website offers tools that allow policyholders to manage their coverage easily, making it a convenient choice for those seeking Cheap Car Insurance in Oregon.

Cons

- Customer Service Variability: Some customers report inconsistent experiences with customer service, which can be a drawback when seeking support for Cheap Car Insurance in Oregon.

- Initial Quotes Can Be Higher: Travelers may provide higher initial quotes compared to some competitors, which can make finding Cheap Car Insurance in Oregon more challenging.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#5 – The Hartford: Best for experienced Drivers

Pros

- Strong A.M. Best Ratings: The Hartford boasts high financial stability ratings, giving peace of mind to those seeking reliable coverage through cheap car insurance in Oregon, and does the Hartford offer enhanced rental car coverage?.

- Excellent Claims Support: Known for its efficient claims process, The Hartford ensures timely assistance, which is crucial for customers needing support after an incident covered by Cheap Car Insurance in Oregon.

- Unique AARP Discounts: The Hartford offers special discounts for AARP members, making it an attractive option for seniors looking for Cheap Car Insurance in Oregon. Check out our article titled “Does The Hartford offer enhanced rental car coverage?” to learn more.

Cons

- Higher Premiums for Young Drivers: Similar to some competitors, The Hartford may have higher rates for younger and less experienced drivers, which can be a challenge when looking for Cheap Car Insurance in Oregon.

- Limited Online Tools: While their customer service is strong, some customers find the online management tools less intuitive, which can be inconvenient when seeking Cheap Car Insurance in Oregon.

#6 – American Family: Best for Customer Service

Pros

- Customizable Policies: American Family offers a range of customizable coverage options, allowing drivers to tailor their plans to specific needs, making it a good choice for Cheap Car Insurance in Oregon.

- Strong Discounts for Bundling: They provide significant discounts for bundling auto with home or other insurance types, which can lead to substantial savings for those seeking Cheap Car Insurance in Oregon.

- User-Friendly Mobile App: Their mobile app allows easy management of policies and claims, enhancing convenience for customers looking for Cheap Car Insurance in Oregon. Read our article “How to File an Car Insurance Claim With American Family Insurance Company“.

Cons

- Higher Rates for Newer Drivers: New drivers may face higher premiums with American Family, making it challenging to find Cheap Car Insurance in Oregon if you lack driving experience.

- Limited Availability in Some Areas: Their services may not be available in all regions of Oregon, which can restrict options for drivers seeking Cheap Car Insurance in Oregon.

#7 – Nationwide: Best for SmartRide Program

Pros

- Wide Range of Coverage Options: Nationwide provides diverse coverage plans, catering to different driver needs and budgets for Cheap Car Insurance in Oregon.

- Unique Vanishing Deductible Program: With our Nationwide car insurance review, their program rewards safe driving by reducing deductibles, helping customers save on their Cheap Car Insurance in Oregon.

- Discounts for Good Students: They offer discounts for young drivers with good academic performance, making it easier for families to secure Cheap Car Insurance in Oregon.

Cons

- Higher Premiums for Some Drivers: Nationwide’s rates can be on the higher side for certain demographics, which might make it difficult for some to find Cheap Car Insurance in Oregon.

- Limited Availability of Local Agents: Depending on the region, customers may find fewer local agents available, which could impact personal service when looking for Cheap Car Insurance in Oregon.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#8 –Farmers: Best for Comprehensive Discounts

Pros

- Customizable Policies: Farmers offers a variety of options for coverage, allowing drivers to tailor their policies for Cheap Car Insurance in Oregon based on individual needs.

- Discounts for Bundling: They offer significant savings when bundling multiple policies, making it a cost-effective choice for Cheap Car Insurance in Oregon. Check our article for more details. “Farmers Insurance Review & Ratings.”

- Unique Coverage Options: Farmers provides specialized coverage options like rideshare insurance, appealing to those who drive for services like Uber or Lyft looking for Cheap Car Insurance in Oregon.

Cons

- Higher Premiums for Young Drivers: Young and inexperienced drivers may face higher rates, which can make it difficult for them to find Cheap Car Insurance in Oregon.

- Mixed Customer Service Reviews: Some customers report varying experiences with customer service, which could impact satisfaction when seeking Cheap Car Insurance in Oregon.

#9 – Liberty Mutual: Best for Tailored Coverage

Pros

- Flexible Coverage Options: Liberty Mutual provides customizable coverage plans, allowing drivers to find the right fit for their needs regarding Cheap Car Insurance in Oregon.

- Bundling Discounts Available: Customers can save significantly by bundling home and auto insurance, enhancing the value of Cheap Car Insurance in Oregon. Look more on our Liberty Mutual auto insurance review.

- Rewards for Safe Driving: Their Drive Well program offers rewards for safe driving habits, allowing drivers to lower their costs for Cheap Car Insurance in Oregon.

Cons

- Higher Initial Quotes: Liberty Mutual may offer higher initial quotes compared to other providers, which can deter customers seeking Cheap Car Insurance in Oregon.

- Claims Process Complexity: Some customers have reported challenges with the claims process, which can be a concern during emergencies covered by Cheap Car Insurance in Oregon.

#10 – Allstate: Best for Claims Service

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage choices, making it easy for drivers to find the right protection for Cheap Car Insurance in Oregon.

- Reward Programs: Their Drivewise program rewards safe driving with cashback, enhancing affordability for those seeking Cheap Car Insurance in Oregon. Take a look at our Allstate auto insurance review to learn more.

- Strong Financial Ratings: Allstate has solid financial stability, which is important for customers wanting assurance in their provider when choosing Cheap Car Insurance in Oregon.

Cons

- Higher Premiums for Some: Allstate may charge higher premiums compared to other providers, particularly for younger or less experienced drivers seeking Cheap Car Insurance in Oregon.

- Complicated Claims Process: Some customers report challenges with the claims process, which could be frustrating when dealing with emergencies covered under their Cheap Car Insurance in Oregon.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding Car Insurance in Oregon

Before diving into finding cheap car insurance, it’s important to understand the basics of car insurance and review insurance company reviews and ratings. Car insurance provides financial protection in case of accidents or other unforeseen circumstances.

In Oregon, car insurance is mandatory, meaning every driver must have a minimum level of coverage to legally operate a vehicle. When considering car insurance, factors such as the type of coverage, legal requirements, and premium costs are essential.

Understanding these aspects and consulting insurance company reviews and ratings will help you make informed decisions when choosing a policy.

Oregon Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $78 | $153 |

| American Family | $54 | $106 |

| Farmers | $57 | $110 |

| Geico | $47 | $93 |

| Liberty Mutual | $71 | $141 |

| Nationwide | $56 | $111 |

| Progressive | $39 | $78 |

| State Farm | $38 | $75 |

| The Hartford | $50 | $98 |

| Travelers | $49 | $97 |

Car insurance policies typically consist of several components. Liability coverage provides compensation for damages or injuries to other parties if you are at fault in an accident. This coverage is crucial as it protects you from potential lawsuits and financial burdens.

Collision coverage, on the other hand, pays for damages to your own vehicle, regardless of fault. This coverage is especially important if you have a newer or more expensive car that would be costly to repair or replace.

Additionally, comprehensive coverage protects against damages caused by events like theft, vandalism, or natural disasters. It provides peace of mind knowing that you are covered in various situations.

The Basics of Car Insurance

Liability coverage is a key component of car insurance policies. It ensures that you are financially protected if you cause an accident that results in injuries or damages to others.

This coverage typically includes bodily injury liability, which compensates for medical expenses, lost wages, and other damages suffered by the injured party.

Property damage liability coverage, as the name suggests, covers the cost of repairing or replacing property damaged in an accident, while collision coverage is designed to protect your own vehicle. To find the best rates for these coverages, it’s helpful to compare online car insurance quotes.

Whether you are at fault or not, this coverage will pay for the repairs or replacement of your car in the event of a collision. This is particularly important if you rely on your vehicle for daily transportation or if you have a loan or lease on the vehicle.

Comprehensive coverage provides a wider scope of protection. It covers damages to your vehicle that are not caused by a collision, such as theft, vandalism, fire, or natural disasters.

This coverage is especially valuable if you live in an area prone to certain risks, such as theft or extreme weather conditions.

Oregon’s Car Insurance Requirements

In order to comply with Oregon law, drivers must have a minimum level of car insurance coverage. As of 2021, the state requires at least $25,000 per person and $50,000 per accident in bodily injury liability coverage.

This means that if you cause an accident and someone is injured, your insurance will provide up to $25,000 per person or $50,000 total for all injured parties.

Additionally, Oregon requires $20,000 in property damage liability coverage, which covers the cost of repairing or replacing property damaged in an accident.

It’s important to note that these are the minimum requirements set by the state. Depending on your personal circumstances, opting for higher coverage limits, including adequate Personal Injury protection, may be beneficial to ensure you are fully protected.

While higher coverage limits and Personal Injury protection may result in higher premiums, they can save you from significant financial burdens in the event of a serious accident.

Now that you have a better understanding of car insurance in Oregon, you can make informed decisions when shopping for a policy. Remember to consider your individual needs, budget, and the level of personal injury protection you desire. By doing so, you can find the right car insurance coverage that provides peace of mind on the road.

Factors Influencing Car Insurance Rates in Oregon

Understanding the factors that influence car insurance rates can help you find the most affordable options for your needs. Insurance companies consider several key factors when determining your premiums. When it comes to car insurance rates in Oregon, there are many factors at play.

One of the most significant factors is your age and driving experience. Younger, less experienced drivers generally pay higher rates due to their higher risk of accidents. Insurance companies view them as more likely to engage in risky behaviors on the road, such as speeding or distracted driving.

On the other hand, older drivers with more experience may be eligible for lower rates. This is because they have had more time to develop safe driving habits and are less likely to take unnecessary risks. Another factor that insurance companies take into account is the make and model of your vehicle.

The type of car you drive can impact your insurance rates significantly, just as it does with life insurance. Cars with expensive parts or high repair costs are typically more expensive to insure because, if your car gets damaged or needs repairs, the insurance company will have to cover higher costs.

Similarly, with life insurance, higher-risk factors like health conditions can increase your premiums. So, if you own a luxury or sports car, you can expect to pay higher premiums compared to someone who drives a more affordable and practical vehicle.

Your driving record and claims history also play a significant role in determining your insurance rates, much like how life insurance companies consider your health and lifestyle.

If you have a clean driving record with no accidents or traffic violations, you are considered a low-risk driver and may qualify for lower premiums. On the other hand, if you have a history of accidents or claims, insurance companies will see you as a higher risk and may charge you higher rates.

It’s important to note that insurance rates can vary from one company to another. Each insurance provider has its own formula for calculating premiums, which means that the weight given to each factor may differ.

Therefore, it’s always a good idea to shop around and compare quotes from multiple insurance companies to ensure you’re getting the best possible rate.

Top Affordable Car Insurance Providers in Oregon

Finally, let’s take a look at some of the top affordable car insurance providers in Oregon:

State Farm Review

State Farm is known for its competitive rates and excellent customer service, and they offer a variety of coverage options to suit different needs and budgets. Although State Farm has a strong reputation for reliability and affordability, it’s important to note that they have been involved in several class action lawsuits law cases, which may be relevant for those considering their insurance services.

They have been serving Oregon drivers for over 20 years and have built a solid reputation in the industry.

Their team of dedicated agents are always ready to assist customers in finding the best coverage options that fit their specific requirements. One of the key features that sets State Farm apart is their commitment to customer satisfaction.

They have a 24/7 customer service helpline, ensuring that policyholders can reach out for assistance at any time. Whether it’s a simple inquiry or a claim that needs to be filed, their friendly and knowledgeable staff are always available to provide support.

Progressive Review

Progressive has a strong reputation for providing affordable car insurance to Oregon drivers. They have a user-friendly online platform that allows customers to easily manage their policies.

Progressive understands the importance of convenience in today’s fast-paced world. That’s why they have invested in a state-of-the-art online platform that enables policyholders to access and manage their car insurance policies with ease.

From making payments to updating personal information, everything can be done with just a few clicks. In addition to their user-friendly platform, Progressive also offers a range of discounts to help customers save even more on their car insurance premiums.

For those seeking legal advice online, Progressive’s platform makes it easy to access necessary resources. They have discounts for safe drivers, students with good grades, and even for bundling multiple policies together. This commitment to affordability has made them a popular choice among Oregon drivers.

Geico Review

Geico offers comprehensive coverage options at affordable rates. They have a range of discounts available, making them a popular choice for many Oregon drivers. When it comes to finding the right car insurance coverage, Geico understands that one size does not fit all.

That’s why they offer a wide range of coverage options, allowing customers to customize their policies to meet their specific needs. From liability coverage to comprehensive and collision coverage, they have it all.

Furthermore, Geico believes in rewarding safe driving habits by offering discounts for drivers with a clean record and those who have completed defensive driving courses. This focus on safe driving not only helps policyholders save money but also promotes responsible driving habits on Oregon roads. For additional resources, small claims court links to each state can assist with understanding your rights in disputes.

In conclusion, finding cheap car insurance in Oregon is possible by understanding the basics of car insurance, complying with state requirements, considering factors that influence rates, and taking advantage of discounts.

Brandon Frady Licensed Insurance Agent

By shopping around and researching different providers, you can find affordable coverage that meets your needs. Remember to compare quotes, maintain a clean driving record, and consider the various discounts available to you. With these strategies, you can secure the car insurance you need at a price you can afford.

Frequently Asked Questions

What factors affect the cost of car insurance in Oregon?

Several factors can influence the cost of car insurance in Oregon. These include your age, driving history, type of vehicle, coverage limits, deductible amount, and even where you live within the state.

Are there any specific car insurance requirements in Oregon?

Yes, Oregon law mandates that all drivers carry a minimum amount of liability insurance coverage. The current minimum requirements are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage per accident.

Can I get cheap car insurance in Oregon if I have a bad driving record?

Having a bad driving record can make it more challenging to find cheap car insurance in Oregon. However, shopping around and comparing quotes from different insurance providers can help you find the most affordable options available to you.

What are some ways to save money on car insurance in Oregon?

There are several ways to save money on car insurance in Oregon. You can consider raising your deductible, maintaining a clean driving record, bundling your car insurance with other policies, taking advantage of available discounts, and comparing quotes from multiple insurance companies.

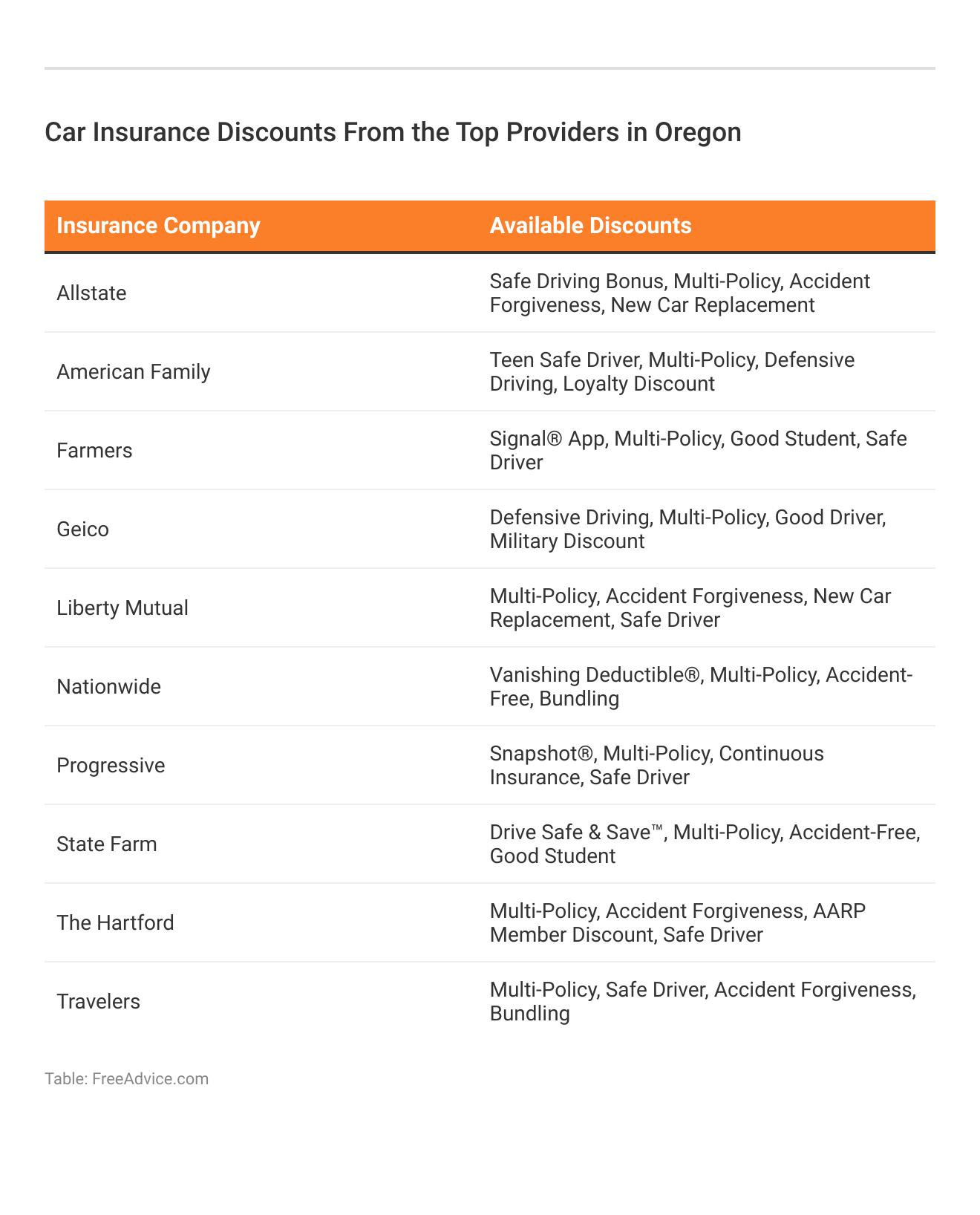

Are there any discounts available for car insurance in Oregon?

Yes, many insurance companies in Oregon offer various discounts that can help lower your car insurance premiums. These discounts may include safe driver discounts, multi-policy discounts, good student discounts, low mileage discounts, and more. It’s worth checking with your insurance provider to see which discounts you may qualify for.

What should I do if I can’t afford car insurance in Oregon?

If you’re struggling to afford car insurance in Oregon, you should reach out to the Oregon Department of Consumer and Business Services. They can provide information about the Oregon Automobile Insurance Plan (OAIP), which is designed to help high-risk drivers obtain the required insurance coverage.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.