Best Car Insurance for Non-Emergency Medical Transportation in 2025 (Top 10 Companies Ranked)

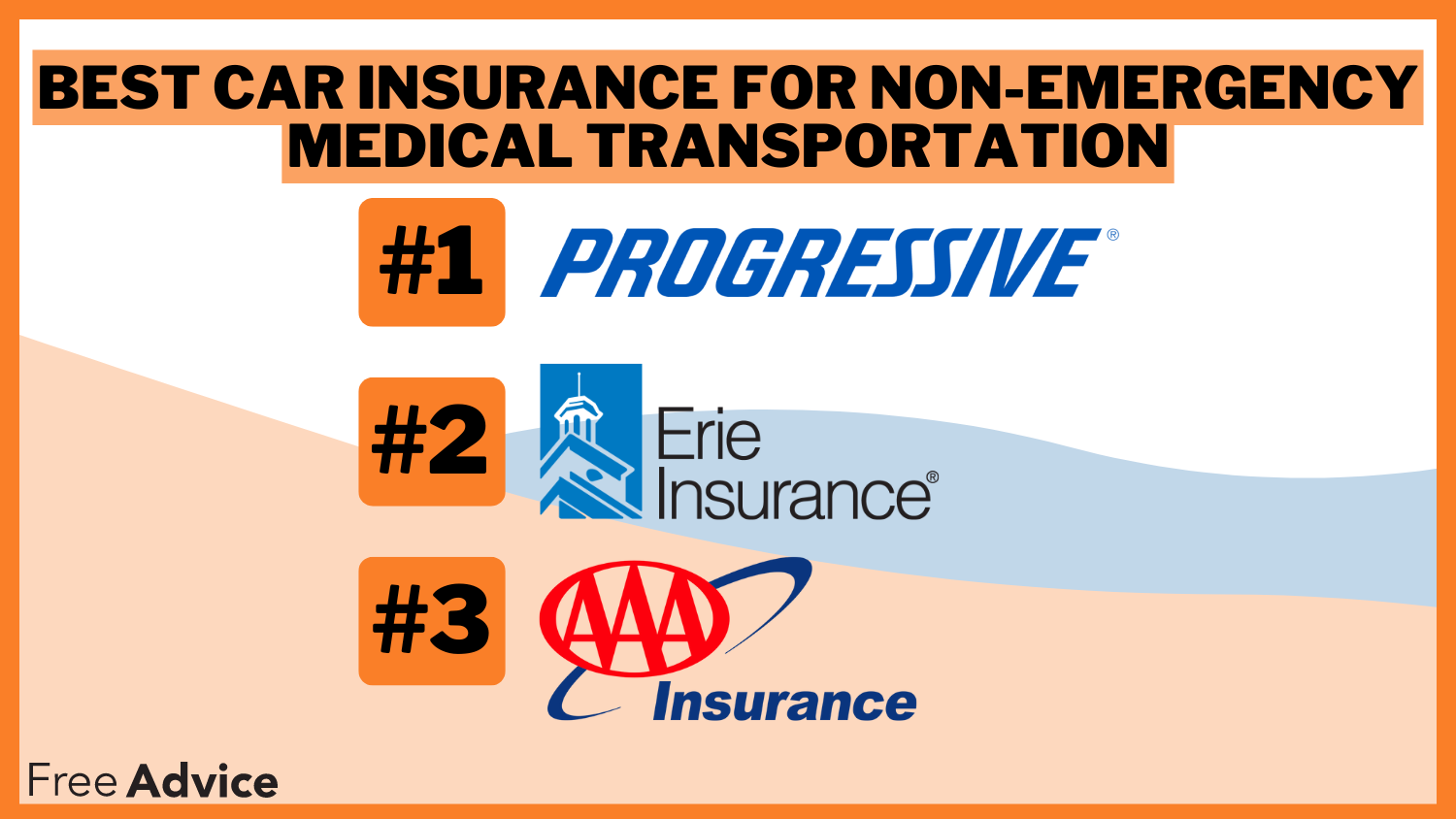

With the best car insurance for non-emergency medical transportation, Progressive, AAA, and Erie offer tailored coverage options with the lowest offer starting at $123/month. Explore this article and see options for the best car insurance for non-emergency medical transportation to find the right fit.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

UPDATED: Sep 29, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 29, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Non-Emergency Medical Transportation

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Non-Emergency Medical Transportation

A.M. Best Rating

Complaint Level

1,883 reviews

1,883 reviewsFind the best car insurance for non-emergency medical transportation with Progressive, AAA, and Erie, starting at just $123 monthly.

If you work in non-emergency medical transportation, having the right auto insurance coverage is crucial. One key aspect to consider is whether the claim settlement is fair.

In this article, we will explore everything you need to know about the best auto insurance options for non-emergency medical transportation drivers, including how to ensure that your insurance provider offers a fair claim settlement.

Our Top 10 Company Picks: Best Car Insurance for Non-Emergency Medical Transportation| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Tight Budgets | Progressive | |

| #2 | 20% | A | Roadside Assistance | AAA |

| #3 | 30% | A+ | Filing Claims | Erie |

| #4 | 17% | B | Customer Service | State Farm | |

| #5 | 13% | A++ | Bundling Policies | Travelers | |

| #6 | 20% | A+ | Widespread Availability | Nationwide |

| #7 | 25% | A | Affinity Discounts | Liberty Mutual |

| #8 | 5% | A+ | Organization Discount | The Hartford |

| #9 | 25% | A++ | Online Convenience | Geico | |

| #10 | 25% | A+ | Infrequent Drivers | Allstate |

We’ll cover everything from understanding the importance of non-emergency medical transportation to evaluating insurance providers. Let’s get started. Enter your ZIP code above.

- Auto insurance is vital for non-emergency medical vehicles

- Progressive, AAA, and Erie start at $123/mo

- Best car insurance for non-emergency medical vehicle

#1 — Progressive: Top Overall Pick

Pros

- Comprehensive Coverage: Their policies include liability, collision, and comprehensive coverage, ensuring well-protected transport needs. Read more in our Progressive insurance review.

- Competitive Bundling Discounts: A 10% bundling discount offers affordable rates, making it easier to manage costs while securing full coverage.

- Top-Ranked Provider: Progressive ranks #1 and has an A+ rating from A.M. Best, highlighting its financial stability and reliable service.

Cons

- Higher Premiums for Certain Drivers: Some drivers may face higher premiums, which could impact the affordability of coverage.

- Limited Customer Service Options: While Progressive excels in many areas, its customer service options may not be as extensive as other providers, which might impact the overall experience.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#2 — AAA: Best for Roadside Assistance

Pros

- Excellent Roadside Assistance: AAA is known for its reliable roadside support, offering prompt assistance for vehicle issues during transport. Visit our AAA insurance review to learn more.

- Attractive Bundling Discounts: AAA offers a 20% bundling discount, which provides substantial savings and reduces overall insurance costs for transport services.

- Strong Financial Stability: With an A rating from A.M. Best, AAA is financially solid, ensuring reliability for your vehicle insurance needs.

Cons

- Higher Rates for Certain Areas: AAA’s premiums may be higher in some regions, depending on the location, impacting overall affordability.

- Limited Coverage Options: AAA’s insurance coverage may be less comprehensive than that of other providers, offering fewer options for specialized needs.

#3 — Erie: Best for Filing Claims

Pros

- Exceptional Claims Handling: Erie is renowned for its swift and efficient claims process, ensuring that issues are resolved with minimal hassle.

- Generous Bundling Discount: Erie offers a 30% bundling discount, making it an affordable option for drivers. Read our article entitled “Erie Insurance Review” for more details.

- Top-Rated Financial Strength: Erie holds an A+ rating from A.M. Best, indicating strong financial stability and reliability.

Cons

- Regional Availability Limitations: Erie may not be available in certain states, limiting potential policyholders’ access to specific areas.

- Potentially Higher Costs for Add-Ons: Optional coverages can raise premiums, affecting overall affordability for some drivers.

#4 — State Farm: Best for Customer Service

Pros

- Outstanding Customer Service: State Farm is known for its exceptional customer service, focusing on client satisfaction and personalized support.

- Competitive Bundling Discounts: Offering a 17% bundling discount, State Farm provides valuable savings, making it a cost-effective choice.

- High Customer Satisfaction Ratings: State Farm ranks highly for customer service, ensuring a positive experience. Read our State farm insurance review for more details.

Cons

- Lower A.M. Best Rating: With a B rating from A.M. Best, State Farm’s financial stability may not be as strong as other top insurers.

- Higher Premiums for Some Drivers: Certain drivers may find State Farm’s premiums higher than competitors, affecting overall affordability.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#5 — Travelers: Best for Bundling Policies

Pros

- Excellent Bundling Discounts: Travelers offers a 13% bundling discount, reducing overall costs for drivers seeking to combine policies.

- Top Financial Strength: With an A++ rating from A.M. Best, Travelers provides solid financial backing, ensuring reliable claim payouts.

- Comprehensive Coverage Options: Travelers offer a wide range of coverage, making it flexible for various drivers and specific needs.

Cons

- Limited Coverage in Some Areas: Travelers may not be available in all regions, limiting driver access in certain states. Learn more in our article “Travelers Insurance Review.”

- Potential Complexity in Policies: The wide variety of coverage options could be confusing, making it harder for some drivers to choose the best plan.

#6 — Nationwide: Best for Widespread Availability

Pros

- Wide Availability: Nationwide’s extensive coverage across multiple regions makes it a solid option for drivers in various areas.

- Generous Bundling Discount: Nationwide offers a 20% bundling discount, providing significant savings for customers.

- Solid Financial Rating: Nationwide’s A+ rating from A.M. Best underscores its financial strength and reliability.

Cons

- Higher Premiums for Certain Drivers: Some drivers may find Nationwide’s premiums higher, impacting overall affordability.

- Customer Service Variability: The quality of customer service can vary by location, which may affect the user experience. For more details, read our Nationwide insurance review.

#7 — Liberty Mutual: Best for Affinity Discounts

Pros

- Excellent Affinity Discounts: Liberty Mutual offers a 25% affinity discount, reducing costs for many drivers and groups.

- Comprehensive Coverage Options: Liberty Mutual provides extensive coverage tailored to specific needs. Delve more in our article “Liberty Mutual Insurance Review.”

- Strong Financial Stability: Liberty Mutual has an A rating from A.M. Best, making it a financially stable provider offering reliable coverage.

Cons

- Higher Rates in Some Areas: Liberty Mutual’s rates can be higher in certain regions, affecting affordability for some drivers.

- Complex Policy Details: The policies can be intricate, making it harder to understand all coverage options fully.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#8 — The Hartford: Best for Organization Discounts

Pros

- Strong Organization Discounts: Hartford offers a 5% organization discount, making it a cost-effective choice for many drivers.

- Comprehensive Coverage: Hartford offers various coverage options tailored to diverse needs. Read more about this in our article “The Hartford Insurance Review.”

- High Financial Rating: With an A+ rating from A.M. Best, The Hartford ensures financial reliability and stability for its policyholders.

Cons

- Lower Bundling Discount: The 5% bundling discount may be less competitive than other providers, impacting overall affordability.

- Limited Availability: The Hartford might not be accessible in all regions, limiting options for some potential policyholders.

#9 — Geico: Best for Online Convenience

Pros

- Convenient Online Services: Geico emphasizes online convenience, making it easy for customers to manage their policies and access services.

- High Bundling Discount: With a 25% bundling discount, Geico offers significant savings for drivers looking to combine policies.

- Top Financial Rating: Geico’s A++ rating from A.M. Best reflects its strong financial stability and coverage reliability.

Cons

- Higher Premiums for Some Drivers: Geico’s premiums may be elevated for specific drivers, affecting overall affordability. Explore further with our article, “Geico Insurance Review.”

- Limited In-Person Services: Geico’s focus on online services may limit in-person support options, impacting the experience for customers who prefer face-to-face assistance.

#10 — Allstate: Best for Infrequent Drivers

Pros

- Excellent Coverage for Infrequent Drivers: Allstate offers robust coverage options tailored for infrequent drivers, making it a strong choice for various needs.

- Generous Bundling Discount: With a 25% bundling discount, Allstate provides significant savings, helping to lower overall insurance costs. Read our article “Allstate Insurance Review” for more details.

- Solid Financial Stability: Allstate’s A+ rating from A.M. Best ensures it is a reliable and financially stable option for drivers.

Cons

- Higher Rates for Frequent Drivers: Allstate may charge higher premiums for frequent drivers, impacting overall affordability for some policyholders.

- Complex Policy Details: The complexity of Allstate’s policies can make it challenging to understand and customize coverage, potentially leading to confusion.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding Non-Emergency Medical Transportation

Before exploring auto insurance, let’s first understand non-emergency medical transportation (NEMT). NEMT involves transporting patients who do not require immediate medical attention or emergency care.

It plays a vital role in ensuring that people with mobility challenges can access medical appointments, treatments, and other necessary healthcare services.

Non-emergency medical transportation refers to the transportation services provided to individuals who are unable to use traditional means of transportation due to a medical condition or physical limitations.

Non-Emergency Medical Transportation Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $141 | $263 |

| $136 | $265 | |

| $127 | $237 |

| $123 | $249 | |

| $154 | $277 |

| $146 | $273 |

| $132 | $248 | |

| $139 | $256 | |

| $157 | $284 |

| $145 | $259 |

These individuals may require assistance, specialized vehicles, or medical equipment during transport. NEMT services vary and can include ambulatory vehicles, wheelchair vans, and stretcher transportation, depending on the patient’s needs. The importance of non-emergency medical transportation cannot be overstated.

It plays a crucial role in ensuring that individuals can access the medical care they need, improving their overall health outcomes. Without reliable transportation, many patients would struggle to reach medical appointments, leading to delays in care, missed appointments, and worsening of existing health conditions.

For those seeking affordable options, dollar-a-day auto insurance coverage can provide a cost-effective solution to maintain reliable transportation while addressing these critical needs.

Non-emergency medical transportation services provide a lifeline for those who depend on regular medical treatments and therapies. Imagine a scenario where a patient with a chronic illness has to travel long distances to a specialized medical facility for treatment.

Without non-emergency medical transportation, this patient would be faced with significant challenges. They may have to rely on public transportation, which may not be accessible or convenient for their specific needs. This could result in missed appointments or delayed treatments, negatively impacting their health.

Non-emergency medical transportation services are designed to address these challenges by providing specialized vehicles and trained personnel who can safely transport patients to and from medical facilities.

These vehicles are equipped with the necessary medical equipment and supplies to ensure the comfort and safety of the patients during transit. In addition to the physical benefits, non-emergency medical transportation also offers peace of mind to patients and their families.

Knowing that reliable transportation is available allows patients to focus on their health without the added stress of arranging transportation or worrying about missed appointments. Furthermore, non-emergency medical transportation services contribute to the overall efficiency of the healthcare system.

Car Insurance Discounts from the Top Providers for Non-Emergency Medical Transportation| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driving, Anti-Theft, Fleet Discounts |

| Multi-Vehicle, Safe Driving, Bundling, Fleet Discounts | |

| Multi-Vehicle, Safe Driving, Bundling, Fleet Discounts |

| Multi-Vehicle, Safe Driving, Fleet Discounts, Good Credit | |

| Multi-Policy, Safe Driving, Bundling, Fleet Discounts, Vehicle Safety |

| Multi-Vehicle, Safe Driving, Bundling, Fleet Discounts, Loyalty |

| Multi-Vehicle, Safe Driving, Bundling, Fleet Discounts, Pay-in-Full | |

| Multi-Vehicle, Safe Driving, Bundling, Fleet Discounts, Good Student | |

| Multi-Policy, Safe Driving, Fleet Discounts, Anti-Theft, Driver Safety Programs |

| Multi-Policy, Safe Driving, Bundling, Fleet Discounts, Vehicle Safety |

By ensuring that patients can access timely medical care, these services help reduce emergency room visits and hospital admissions that could have been prevented with proper transportation arrangements. Overall, non-emergency medical transportation is a vital component of the healthcare ecosystem.

It bridges the gap between patients and the medical care they need, ensuring that no one is left behind due to transportation challenges. Whether it’s a routine check-up, a scheduled therapy session, or a follow-up appointment, non-emergency medical transportation plays a crucial role in facilitating access to health services.

Read more: Should I Contact a Car Accident Attorney?

The Need for Auto Insurance in Non-Emergency Medical Transportation

As a non-emergency medical transportation driver, it’s essential to recognize the risks involved in your profession and the legal requirements for insurance. Auto insurance safeguards you, your vehicle, and your passengers in the event of an accident, damage, or theft.

Non-emergency medical transportation (NEMT) plays a crucial role in ensuring that individuals with medical needs can access the healthcare services they require.

Whether it’s transporting patients to routine medical appointments or facilitating their safe return home after a hospital stay, NEMT drivers provide a vital service for those who are unable to drive themselves due to physical limitations or health conditions.

However, the nature of NEMT work presents its own unique set of challenges and risks. Transporting patients involves a higher level of risk compared to regular personal driving.

Patients may have specific medical conditions or mobility challenges that increase the likelihood of accidents or injuries during transport. NEMT drivers are responsible for ensuring their safety.

Furthermore, NEMT drivers often encounter unpredictable traffic conditions, adverse weather, and other external factors that can pose significant risks.

The urgency to reach medical facilities promptly, especially during emergencies, adds a layer of pressure and potential hazards on the road. Enter your ZIP code now to compare prices and get the best deals.

Risks Involved in Non-Emergency Medical Transportation

Transporting patients with varying medical needs requires NEMT drivers to possess exceptional driving skills and a deep understanding of medical conditions. It is not uncommon for patients to have limited mobility or chronic illnesses. These factors can make them more vulnerable to accidents during transportation.

For instance, patients with mobility challenges may require assistance getting in and out of the vehicle, which can be physically demanding for the driver. Moreover, sudden braking or swerving to avoid a collision can have a more severe impact on individuals with fragile health conditions, potentially exacerbating their medical issues.

In such cases, long-term care insurance can be a valuable addition to auto insurance. It helps cover extended medical needs and provides support for the ongoing care of these patients, ensuring their safety and well-being.

Additionally, the long hours spent on the road can take a toll on NEMT drivers’ physical and mental well-being. Fatigue and stress can impair their judgment and reaction times, increasing the likelihood of accidents. NEMT drivers must prioritize their health and well-being to ensure the safety of both themselves and their passengers.

Legal Requirements for Insurance

Every state has its own set of legal requirements for auto insurance. As an NEMT driver, you must ensure that you comply with these requirements. Adequate liability insurance is typically a legal requirement for non-emergency medical transportation, as it protects you financially in an accident where you are at fault.

Liability insurance provides coverage for bodily injury and property damage caused to others in an accident. It not only protects you from potential lawsuits and financial obligations but also provides peace of mind, knowing that you have the necessary coverage to handle any unforeseen circumstances that may arise.

Moreover, having comprehensive auto insurance for your NEMT vehicle is essential to safeguard your investment. Your vehicle is a critical tool for your profession, and any damage, theft, or loss can significantly impact your ability to continue providing essential transportation services to those in need.

When selecting auto insurance for your NEMT vehicle, consider the specific risks associated with your profession. Look for policies that offer coverage for medical expenses, vehicle repairs, and even your passengers’ personal belongings.

Read more: Best Car Insurance for Firefighters

Evaluating the Best Auto Insurance Options

Let’s explore how to evaluate the best insurance options for your specific needs now that we understand the importance of auto insurance in non-emergency medical transportation. A critical question to consider is, how do I know if I chose the right coverages?

We’ll help you assess whether your current insurance policy adequately meets your needs and what factors to look for to ensure optimal coverage.

Auto insurance is crucial to running a successful non-emergency medical transportation (NEMT) business. It protects your vehicles and provides coverage for any potential liability and medical expenses that may arise.

When it comes to choosing the right auto insurance for your NEMT business, several factors must be considered to ensure the best coverage possible.

Top Insurance Providers for Non-Emergency Medical Transportation

Certain insurance providers stand out in the market for NEMT auto insurance because they offer specialized coverage tailored to the needs of non-emergency medical transportation drivers.

Among the top insurance providers for NEMT drivers are Provider 1, Provider 2, and Provider 3. These providers understand the unique risks and challenges faced by NEMT businesses and offer comprehensive coverage to address those needs.

Provider 1 is known for its extensive experience in the NEMT industry. It offers customizable insurance plans that can be tailored to your business’s specific requirements. Its policies include coverage for liability, comprehensive, collision, and medical payment, ensuring that you have the necessary protection in all aspects of your business.

Provider 2, on the other hand, is renowned for its exceptional customer service and competitive rates. They pride themselves on their quick claims process and dedicated support team, ensuring that you receive the assistance you need when you need it the most.

Their policies also include a range of additional benefits, such as roadside assistance and rental reimbursement, to provide you with added peace of mind.

Lastly, Provider 3 is a trusted name in the NEMT insurance industry, known for its comprehensive coverage options and flexible payment plans. They understand the financial constraints that NEMT businesses often face and strive to provide affordable yet reliable insurance solutions.

Their policies offer a wide range of coverage options, including liability, comprehensive, collision, and medical payment, allowing you to choose the coverage that best suits your needs and budget.

When evaluating the best insurance options for your NEMT business, it is essential to consider these top insurance providers and compare their coverage, benefits, and pricing.

By doing so, you can make an informed decision that will protect your business and provide you with the peace of mind you need to focus on providing exceptional non-emergency medical transportation services.

Read more: Diminished Value & Car Insurance

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Detailed Reviews of Top Auto Insurance Providers

Provider 1: Coverage and Benefits

Provider 1 offers comprehensive insurance coverage for non-emergency medical transportation drivers. Their policies include liability coverage to protect against bodily injury and property damage. Enter your ZIP code now.

Choose the right insurance coverage to safeguard yourself, your vehicle, and your passengers from potential financial burdens due to accidents or unforeseen events.Ty Stewart Licensed Insurance Agent

They also provide coverage for accidents involving uninsured or underinsured motorists, ensuring you’re protected even if the other party doesn’t have adequate insurance. Provider 1’s policies come with competitive rates and flexible payment options to suit your budget.

Provider 2: Coverage and Benefits

Provider 2 specializes in auto insurance for non-emergency medical transportation drivers. They offer policies that cover liability, collision, comprehensive, and medical payments. Provider 2 understands the unique risks faced by NEMT drivers and tailors their coverage to meet specific needs.

In addition, they provide prompt and efficient claims handling, ensuring you receive the support you need in case of an accident or mishap.

Provider 3: Coverage and Benefits

Provider 3 is known for its extensive coverage options and exceptional customer service. They offer liability coverage, as well as additional benefits such as roadside assistance, rental reimbursement, and personal injury protection.

Provider 3 understands that NEMT drivers require reliable coverage and ensures that their policies cater to those needs. With Provider 3, you can rest assured that you have the necessary protection on the road.

Read more: Does Grange Insurance car insurance cover damage to my windshield?

Finding the Right Insurance for Non-Emergency Medical Transportation

In conclusion, choosing the best auto insurance for non-emergency medical transportation is crucial for ensuring both driver and patient safety. Companies like Progressive, AAA, and Erie provide comprehensive, tailored policies that cater specifically to the unique risks faced by NEMT drivers.

With competitive rates, drivers can secure affordable coverage that protects their vehicles, passengers, and overall business operations. By evaluating factors such as liability, medical payments, and customer service, NEMT providers can find the right insurance fit to support their essential work in the healthcare system.

For those seeking optimal coverage, it is essential to compare quotes and review policy details. Enter your ZIP code to explore the best options available.

Frequently Asked Questions

What is non-emergency medical transportation (NEMT)?

Non-emergency medical transportation (NEMT) refers to transportation services specifically designed to transport individuals who do not require immediate medical attention but still need assistance or specialized vehicles to travel to medical appointments, clinics, or other healthcare facilities.

Why do non-emergency medical transportation drivers need car insurance?

Non-emergency medical transportation drivers need car insurance to protect themselves, their passengers, and their vehicles in case of accidents, injuries, or property damage that may occur during transportation.

Car insurance provides financial coverage for medical expenses, vehicle repairs, or legal costs that may arise from such incidents. Enter your ZIP code now.

What type of car insurance do non-emergency medical transportation drivers need?

Non-emergency medical transportation drivers typically need commercial auto insurance. This type of insurance is specifically designed for vehicles used for business purposes, such as transporting passengers.

Commercial auto insurance provides coverage for liability, collision, comprehensive, and other optional coverages tailored to the unique risks faced by NEMT drivers.

Read more: Car Insurance for a Totaled Car

How can non-emergency medical transportation drivers find affordable car insurance?

Non-emergency medical transportation drivers can find affordable car insurance by shopping around and comparing quotes from multiple insurance providers. It is recommended to consult with insurance agents or brokers who specialize in commercial auto insurance for NEMT drivers.

Additionally, maintaining a clean driving record, implementing safety measures, and choosing vehicles with good safety ratings can help lower insurance premiums.

What factors affect the cost of car insurance for non-emergency medical transportation drivers?

The cost of car insurance for non-emergency medical transportation drivers can be influenced by various factors, including the driver’s age, driving experience, location, the value of the vehicle, the coverage limits chosen, and the driver’s claims history.

Additionally, the number of passengers transported, the distance traveled, and the driver’s safety measures and training may also impact insurance costs. Enter your ZIP code now and compare prices.

Can non-emergency medical transportation drivers use personal auto insurance?

Using personal auto insurance for non-emergency medical transportation purposes is generally not recommended. Personal auto insurance policies typically exclude coverage for vehicles used for commercial purposes.

If a driver is involved in an accident while using their personal vehicle for NEMT services, their insurance company may deny the claim, leaving the driver responsible for all costs.

Read more: Best Car Insurance for Seniors in Nebraska

What is the best car insurance for non-emergency medical transportation?

The best car insurance for non-emergency medical transportation should offer comprehensive coverage tailored to the unique risks of transporting patients. Look for providers that include liability, comprehensive, collision, and medical payments coverage.

Companies like Progressive, AAA, and Erie are noted for their specialized options and benefits.

How do I know if I have the right coverage for non-emergency medical transportation?

To determine if you have the right coverage, assess whether your policy includes the essential types of coverage such as liability, comprehensive, and collision.

Additionally, ensure that your insurer provides fair claim settlements and offers specialized coverage for the unique risks associated with non-emergency medical transportation. Enter your ZIP code now.

What factors should I consider when choosing the best car insurance for non-emergency medical transportation?

Consider factors such as the provider’s A.M. Best rating, bundling discounts, claim settlement process, and specific coverage options. It’s important to choose a provider that offers comprehensive coverage for liability, vehicle damage, and medical expenses, and that has a strong reputation for handling claims fairly.

Are there any discounts available for car insurance tailored to non-emergency medical transportation?

Yes, many insurance providers offer discounts that can reduce your premiums. For example, providers like Erie offer bundling discounts, while Liberty Mutual provides affinity discounts. Be sure to inquire about all available discounts when selecting the best car insurance for non-emergency medical transportation.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.