Best Car Insurance for Bus Drivers in 2026 (Compare the Top 10 Companies)

For the best car insurance for bus drivers, consider top providers like Progressive, State Farm, and Allstate, which offer cheapest rates starting at $75. These companies provide specialized coverage for bus drivers, such as liability protection. Comparing quotes from these leading insurers can help you save.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

UPDATED: Sep 9, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 9, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Bus Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Bus Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, State Farm, and Allstate are the top best car insurance for bus drivers that are offering cheapest rates starting at $75 that covers what your bus needed.

As a bus driver, it is crucial to have the best auto insurance coverage to protect yourself, your passengers, and your vehicle in case of any unforeseen circumstances. However, finding the right insurance for bus drivers can be a daunting task.

Our Top 10 Company Picks: Best Car Insurance for Bus Drivers| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Flexible Options | Progressive | |

| #2 | 17% | B | Comprehensive Coverage | State Farm | |

| #3 | 25% | A+ | Diverse Discounts | Allstate | |

| #4 | 15% | A | Customizable Policies | Farmers | |

| #5 | 20% | A+ | Fleet Coverage | Nationwide |

| #6 | 10% | A | Extensive Coverage | Liberty Mutual |

| #7 | 13% | A++ | Flexible Terms | Travelers | |

| #8 | 10% | A+ | Specialized Programs | The Hartford |

| #9 | 20% | A++ | Reliable Service | Auto-Owners | |

| #10 | 15% | A+ | Strong Support | Erie |

In this article, we will explore everything you need to know about auto insurance for bus drivers, factors to consider when choosing a policy, the top insurance providers in the market, the application process, and tips to lower your premiums. Enter your ZIP code to begin comparing.

- Specialized Coverage: Liability, passenger injuries, comprehensive protection

- Top Providers: Progressive, State Farm, Allstate; rates from $75

- Lower Premiums: Safe driving discounts, bundling policies, defensive driving courses

#1 – Progressive: Top Overall Pick

Pros

- Comprehensive Coverage Options: Progressive offers a wide range of coverage options tailored for bus drivers, making it one of the best car insurance for bus drivers. Their policies include comprehensive, collision, and liability coverage to suit various needs. Discover more through our page, “Progressive Insurance.”

- Flexible Payment Plans: Progressive provides flexible payment plans, which is beneficial for bus drivers with fluctuating income. This flexibility makes Progressive a strong contender for the best car insurance for bus drivers.

- Discounts for Bundling: Progressive offers generous discounts to bus drivers who bundle their auto insurance with other policies, like homeowners or renters insurance. This makes Progressive an attractive choice for those seeking the best car insurance for bus drivers, helping to reduce overall costs while maintaining comprehensive coverage.

Cons

- Higher Premiums for New Drivers: New bus drivers or those with less experience might face higher premiums. This can impact their affordability and make finding the best car insurance for bus drivers more challenging.

- Customer Service Variability: Some customers report mixed experiences with Progressive’s customer service, which can affect their overall satisfaction. This variability might influence whether Progressive is the best car insurance for bus drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Comprehensive Coverage

Pros

- Excellent Comprehensive Coverage: State Farm is known for its extensive coverage options, including liability and passenger protection, making it one of the best car insurance for bus drivers. Their policies ensure that bus drivers are well-protected in various scenarios. Read more on State Farm Insurance.

- Strong Local Agents: With local agents providing personalized service, State Farm helps bus drivers tailor their insurance to specific needs. This personalized approach is a key factor in State Farm being considered the best car insurance for bus drivers.

- Superior Financial Stability: State Farm’s strong financial ratings ensure it can handle claims efficiently, positioning it as a top contender for the best car insurance for bus drivers.

Cons

- Potentially Higher Rates: State Farm’s rates may be higher, particularly for drivers with less-than-perfect records. This can make it less competitive for those seeking the best car insurance for bus drivers.

- Limited Online Management: Some policy management options may be less convenient compared to fully digital platforms. This limitation might affect the ease of use for those considering State Farm as the best car insurance for bus drivers.

#3 – Allstate: Best for Diverse Discounts

Pros

- Diverse Discounts: Allstate offers various discounts, such as safe driving and multi-policy discounts, which can reduce premiums. These discounts contribute to Allstate being a top choice for the best car insurance for bus drivers.

- Customizable Policies: Allstate allows for extensive policy customization, which helps bus drivers get coverage tailored to their specific needs. This flexibility is a significant advantage in finding the best car insurance for bus drivers.

- Personalized Coverage Options: Allstate provides tailored coverage options that can be customized to meet the unique needs of bus drivers, offering flexibility for the best car insurance for bus drivers. Get more information through our Allstate auto insurance review.

Cons

- Complex Policy Terms: Allstate’s policies can be complex, making it challenging for some to fully understand their coverage. This complexity might make it harder for some to determine if Allstate offers the best car insurance for bus drivers.

- Potential for High Rates: Rates can be on the higher side, particularly for those with less ideal driving records. This factor might impact its status as the best car insurance for bus drivers.

#4 – Farmers: Best for Customizable Policies

Pros

- Customizable Coverage: Farmers provides highly customizable insurance policies, which are beneficial for bus drivers needing specific coverage. This customization makes Farmers a strong option for the best car insurance for bus drivers.

- Strong Claims Support: Known for robust claims support, Farmers ensures bus drivers receive prompt assistance when needed. This reliable service is a key reason Farmers is considered among the best car insurance for bus drivers.

- Multiple Discounts Available: Offers discounts for safe driving and bundling, which can help reduce costs for bus drivers. These savings contribute to Farmers being a competitive choice for the best car insurance for bus drivers. For more information, see our article titled “Farmers Insurance.”

Cons

- Higher Premiums for Fleet Coverage: Fleet insurance options may come with higher costs compared to single-vehicle policies. This could make Farmers less appealing to those seeking the best car insurance for bus drivers on a budget.

- Limited Regional Availability: Availability may be restricted in some areas, limiting access for some bus drivers. This regional limitation could affect the ability to secure the best car insurance for bus drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Fleet Coverage

Pros

- Fleet Coverage Options: Nationwide excels in providing insurance for multiple vehicles, making it ideal for bus operators with fleets. Their specialized fleet coverage is a significant advantage in finding the best car insurance for bus drivers.

- Competitive Rates: Generally, offers competitive rates, particularly beneficial for those insuring multiple buses. This cost-effectiveness helps Nationwide stand out as one of the best car insurance for bus drivers. For more details, check out our article, “Nationwide Insurance.“

- Excellent Customer Service: Known for good customer service, Nationwide provides reliable support for bus drivers. This strong service reputation makes Nationwide a solid choice for the best car insurance for bus drivers.

Cons

- Less Flexible Terms: Nationwide might have less flexible terms for individual bus drivers compared to fleet policies. This lack of flexibility could impact its suitability as the best car insurance for bus drivers.

- Higher Rates for Single Buses: Insurance rates may be higher for individuals with only a single bus. This pricing factor could make Nationwide less attractive for those seeking the best car insurance for bus drivers.

#6 – Liberty Mutual: Best for Extensive Coverage

Pros

- Extensive Coverage Options: Liberty Mutual offers a broad range of coverage options, including specialized protection for buses. Their extensive coverage helps make Liberty Mutual a top contender for the best car insurance for bus drivers. For additional information, review our article titled “Liberty Mutual Auto Insurance Review.“

- Good Discounts for Safety Measures: Provides discounts for installing safety features on your bus, which can lower overall premiums. These discounts contribute to Liberty Mutual being considered one of the best car insurance for bus drivers.

- Flexible Payment Options: Offers various payment options to accommodate different financial situations. This flexibility is another reason Liberty Mutual is a viable option for the best car insurance for bus drivers.

Cons

- Complex Policy Details: Policies can be intricate and may require careful review. This complexity might make it challenging to determine if Liberty Mutual is the best car insurance for bus drivers for your needs.

- Potential for Higher Premiums: Premiums can be higher, particularly for high-risk areas or drivers with less ideal records. This potential for higher costs could affect Liberty Mutual’s standing as the best car insurance for bus drivers.

#7 – Travelers: Best for Flexible Terms

Pros

- Flexible Policy Terms: Travelers provides flexible policy terms that can be adjusted based on individual needs. This flexibility is crucial for finding the best car insurance for bus drivers.

- Comprehensive Coverage Options: Offers a wide range of coverage, including liability and physical damage protection, which is essential for bus drivers. This comprehensive approach helps Travelers stand out as one of the best car insurance for bus drivers. You can seek free advice to know more.

- Discounts for Safe Driving: Provides discounts for safe driving practices, which can help reduce premiums. These discounts contribute to Travelers being considered among the best car insurance for bus drivers.

Cons

- Higher Premiums in High-Risk Areas: Premiums may be higher in regions with increased risk. This factor could make Travelers less attractive for those seeking affordable options for the best car insurance for bus drivers.

- Mixed Customer Service Reviews: Some users report mixed experiences with customer service, which may affect overall satisfaction. This variability could impact Travelers’ reputation as the best car insurance for bus drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Specialized Programs

Pros

- Specialized Programs for Bus Drivers: The Hartford offers specialized programs designed specifically for bus drivers, making it a top choice for the best car insurance for bus drivers. These programs address the unique needs of the profession.

- Strong Support for Claims: Known for effective claims support and handling, which is essential for bus drivers. This strong support system is a significant factor in The Hartford’s status as one of the best car insurance for bus drivers. For additional details, read our article on “The Hartford Insurance.“

- Discounts for Safety Training: Offers discounts for completing safety training programs, which can help reduce premiums. This discount feature enhances The Hartford’s appeal as the best car insurance for bus drivers.

Cons

- Potentially Higher Costs: Specialized programs may come with higher costs compared to standard policies. This potential for higher expenses might affect The Hartford’s competitiveness as the best car insurance for bus drivers.

- Limited Regional Availability: Coverage may not be available in all regions, which could limit options for some bus drivers. This limitation might impact the overall appeal of The Hartford as the best car insurance for bus drivers.

#9 – Auto-Owners: Best for Reliable Service

Pros

- Reliable Service: Auto-Owners is known for its reliable customer service and efficient claims processing, making it a strong choice for the best car insurance for bus drivers. Their dependable service is highly valued by customers. To learn more, explore our article on “Auto-Owners Insurance.“

- Customizable Coverage: Offers customizable insurance options that can be tailored to the needs of bus drivers. This level of customization helps Auto-Owners stand out as one of the best car insurance for bus drivers.

- Competitive Rates: Provides competitive rates for comprehensive coverage, which can be advantageous for bus drivers. This pricing strategy supports Auto-Owners’ reputation as a top option for the best car insurance for bus drivers.

Cons

- Fewer Discount Options: May offer fewer discounts compared to some other insurers. This lack of discount opportunities might impact Auto-Owners’ attractiveness as the best car insurance for bus drivers.

- Regional Limitations: Availability may be limited in some areas, potentially restricting options for bus drivers in certain regions. This regional limitation could affect its status as the best car insurance for bus drivers.

#10 – Erie: Best for Strong Support

Pros

- Strong Customer Support: Erie is praised for its strong customer support and service, which is crucial for bus drivers. This excellent service helps Erie stand out as one of the best car insurance for bus drivers. You can seek free advice to know more.

- Good Value for Coverage: Offers good value for comprehensive coverage, providing competitive rates for bus drivers. This value proposition makes Erie a viable option for the best car insurance for bus drivers.

- Discounts for Multi-Vehicle Policies: Provides discounts for insuring multiple vehicles, which can be beneficial for bus drivers with fleets. This feature contributes to Erie’s reputation as one of the best car insurance for bus drivers.

Cons

- Limited Availability: Erie might not be available in all states, which could limit access for some bus drivers. This limitation might affect Erie’s overall appeal as the best car insurance for bus drivers.

- Potentially Higher Rates for Single Vehicles: Rates for insuring a single bus might be higher compared to multi-vehicle policies. This pricing factor could impact Erie’s competitiveness in offering the best car insurance for bus drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding Auto Insurance for Bus Drivers

What is Auto Insurance for Bus Drivers?

Auto insurance for bus drivers is a specific type of coverage designed to meet the unique needs and risks associated with operating a bus. It offers financial protection in the event of accidents, damage, or injuries caused by the bus while on the road.

Bus Driver Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $95 | $185 |

| Auto-Owners | $78 | $155 |

| Erie | $82 | $162 |

| Farmers | $88 | $170 |

| Liberty Mutual | $100 | $195 |

| Nationwide | $80 | $160 |

| Progressive | $75 | $165 |

| State Farm | $90 | $175 |

| The Hartford | $92 | $190 |

| Travelers | $85 | $180 |

When it comes to auto insurance for bus drivers, there are several key factors to consider. The coverage typically includes liability insurance, which protects the driver in case they are at fault in an accident and need to pay for the damages.

Another important aspect of auto insurance for bus drivers is comprehensive coverage. This coverage protects against non-collision related incidents such as theft, vandalism, or natural disasters.

It provides peace of mind knowing that the bus is protected from a wide range of potential risks.

Why is Specific Insurance Needed for Bus Drivers?

Bus drivers require specialized insurance due to the increased risks involved in transporting passengers on a regular basis.

Unlike regular personal auto insurance, bus drivers need coverage for liability arising from injuries to passengers, damage to property, and potential lawsuits resulting from accidents while operating the bus.

Operating a bus comes with its own set of challenges and risks. Bus drivers are responsible for the safety of their passengers, making sure they reach their destinations without any incidents. However, accidents can happen, and when they do, the consequences can be severe.

This is why specific insurance coverage is necessary for bus drivers.

One of the main reasons why specific insurance is needed for bus drivers is the potential for passenger injuries. In the event of an accident, passengers may sustain injuries that require medical attention.

Auto insurance for bus drivers provides coverage for these medical expenses, ensuring that injured passengers receive the necessary care without incurring financial burden.

Factors to Consider When Choosing Auto Insurance

Choosing the right auto insurance as a bus driver involves careful consideration of several important factors. By understanding these factors and making an informed decision, you can ensure that you have the best coverage to protect yourself and your passengers. Let’s explore some key aspects to keep in mind:

Coverage Options

One of the primary factors to consider when selecting auto insurance is the range of coverage options available. As a bus driver, you need to evaluate the specific needs of your profession. The coverage options may include:

- Liability coverage: This coverage protects you in case you are at fault in an accident and need to cover the costs of property damage or bodily injury to others.

- Comprehensive coverage: This coverage provides protection against non-collision incidents, such as theft, vandalism, or natural disasters.

- Collision coverage: This coverage pays for damages to your bus in the event of a collision, regardless of fault.

- Uninsured/underinsured motorist coverage: This coverage safeguards you in case you are involved in an accident with a driver who lacks sufficient insurance coverage.

- Medical payments coverage: This coverage helps cover medical expenses for you and your passengers in the event of an accident.

By thoroughly evaluating these coverage options, you can make an informed decision that aligns with your specific needs and priorities. Enter your ZIP code to begin comparing.

Top Auto Insurance Providers for Bus Drivers

When it comes to finding the right auto insurance provider for bus drivers, it’s important to consider a few key factors. Bus drivers have unique insurance needs, and finding a provider that understands those needs can make all the difference.

In this article, we will explore three top auto insurance providers that cater specifically to bus drivers.

Provider 1 Review

Provider 1 is a leading auto insurance company that offers comprehensive coverage options specifically tailored to meet the needs of bus drivers. With years of experience in the industry, they have gained a strong reputation for excellent customer service and a high claim settlement ratio.

What sets Provider 1 apart from the competition is their deep understanding of the challenges faced by bus drivers.

They have designed their policies to provide extensive coverage for accidents, damages, and liability issues that are unique to bus driving. Whether it’s protecting your vehicle or ensuring the safety of your passengers, Provider 1 has got you covered.

Provider 2 Review

Provider 2 is another top choice for bus drivers seeking reliable and affordable auto insurance coverage. They are known for providing competitive premiums while offering comprehensive coverage options.

One of the standout features of Provider 2 is their user-friendly online platform. Managing your policy has never been easier, thanks to their intuitive interface and convenient tools. From making payments to updating your coverage, everything can be done with just a few clicks.

Provider 2 also understands that bus drivers often have busy schedules, which is why they offer flexible payment options. Whether you prefer monthly installments or annual payments, they have a solution that fits your needs and budget.

Provider 3 Review

If you’re a bus driver looking for specialized insurance solutions, Provider 3 is the perfect choice for you. They specialize in providing insurance coverage tailored specifically to the unique needs of bus drivers.

What sets Provider 3 apart is their commitment to flexibility. They understand that every bus driver has different requirements when it comes to insurance coverage. Whether you need coverage for a single bus or an entire fleet, Provider 3 has customizable options to suit your needs.

Overall, when it comes to choosing the right auto insurance provider for bus drivers, it’s essential to consider factors such as coverage options, customer service, and claims process.

These three providers, Provider 1, Provider 2, and Provider 3, have proven themselves to be reliable choices, offering tailored coverage and excellent service to bus drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

How to Apply for Auto Insurance as a Bus Driver

Applying for auto insurance as a bus driver can be a detailed process, but with the right information and documents, it can be a smooth experience. In this guide, we will walk you through the necessary steps to get the coverage you need.

Documents Needed

When applying for auto insurance as a bus driver, you will generally need to provide certain documents. These may include your driver’s license, bus registration and ownership documents, proof of address, and any additional documents required by the insurance provider.

Your driver’s license is a crucial document that verifies your eligibility to drive a bus. It is essential to ensure that your license is valid and up to date before applying for insurance.

The insurance provider will also require your bus registration and ownership documents to confirm that you are the rightful owner and operator of the vehicle. Depending on the insurance provider and the specific requirements, you may also need to provide additional documents.

Application Process

The application process typically involves filling out an online form, providing the necessary documents, and answering a series of questions about your driving history and the bus you operate. It is crucial to be thorough and accurate when completing the application to ensure that you receive an accurate quote.

When filling out the online form, you will be asked for personal information such as your name, contact details, and date of birth. Additionally, you will need to provide details about your bus, including its make, model, year, and any modifications or safety features it has.

This information helps the insurance provider assess the risk associated with insuring your vehicle.

Along with the basic information, you will also be required to answer questions about your driving history. These questions may include inquiries about accidents, tickets, or any previous insurance claims you have made.

Once you have completed the online form and submitted the necessary documents, the insurance provider will review your application. They will assess the information provided and evaluate the risk associated with insuring you as a bus driver.

Based on their evaluation, they will provide you with a quote that outlines the cost of your insurance coverage.

Tips to Lower Your Auto Insurance Premiums

Safe Driving Discounts

One way to lower your insurance premiums is by maintaining a good driving record. Insurance companies often offer safe driving discounts to drivers with no or minimal accidents or traffic violations. Additionally, consider taking defensive driving courses to enhance your driving skills and potentially qualify for further premium discounts.

Bundling Insurance Policies

Bundling insurance policies is an excellent strategy for finding the best car insurance for bus drivers. By combining your auto insurance policy with other types, like home or renters insurance, you may qualify for multi-policy discounts.

Tim Bain Licensed Insurance Agent

To secure the best car insurance as a bus driver, consider the potential savings from bundling, research top providers, and carefully navigate the application process. Consider the top best car insurance for bus drivers that are offering cheapest rates starting at $75 including Progressive, State Farm, and Allstate.

Compare quotes, review policy details, and ensure that your decision protects you, your passengers, and your livelihood while you’re on the road by entering your ZIP code.

Frequently Asked Questions

What is car insurance for bus drivers?

Car insurance for bus drivers is a specific type of insurance coverage designed for individuals who drive buses as part of their profession or occupation. It provides protection against potential damages, accidents, and liabilities that may occur while operating a bus.

What does car insurance for bus drivers typically cover?

Car insurance for bus drivers typically covers liability protection, which includes bodily injury and property damage liability. It may also include coverage for medical payments, uninsured/underinsured motorist protection, and physical damage coverage for the bus itself. Enter your ZIP code to compare rates and find the best insurance for your needs.

Are there any specific requirements for car insurance for bus drivers?

Yes, there are specific requirements for car insurance for bus drivers. The exact requirements may vary depending on the jurisdiction and the type of bus being driven. Bus drivers may need to meet certain minimum liability coverage limits set by the state or regulatory authorities.

Can bus drivers add additional coverage options to their car insurance?

Yes, bus drivers can often add additional coverage options to their car insurance policy. These options may include comprehensive coverage, collision coverage, roadside assistance, rental reimbursement, and coverage for personal belongings inside the bus.

Do bus drivers pay higher insurance premiums compared to regular car drivers?

Insurance premiums for bus drivers may be higher compared to regular car drivers due to the increased risk associated with operating a larger vehicle. Factors such as the driver’s age, driving record, and the type of bus being driven can also influence the insurance premium. Enter your ZIP code to find the best insurance for your needs.

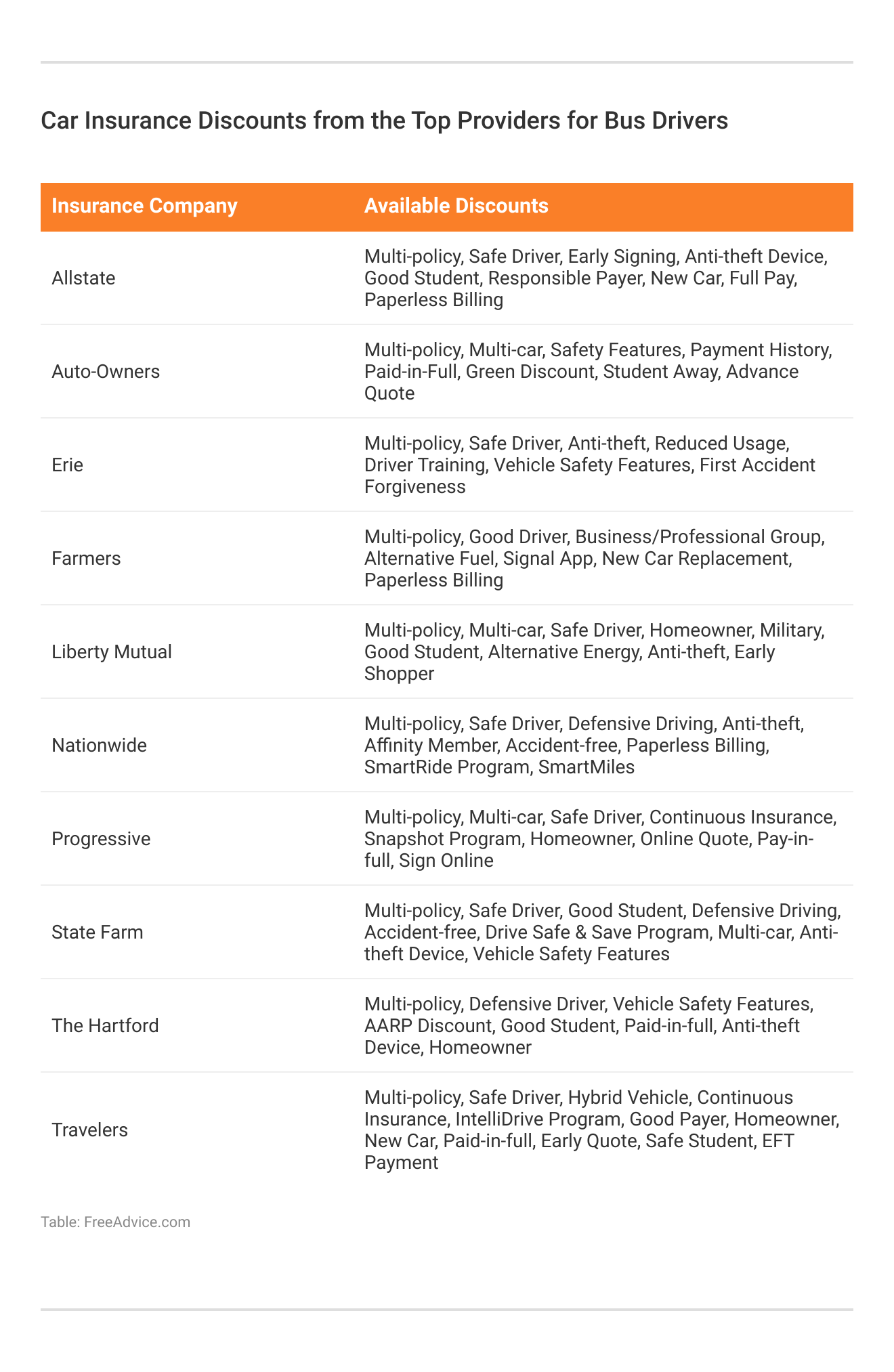

Are there any discounts available for bus drivers on their car insurance?

Yes, some insurance companies offer discounts specifically for bus drivers. These discounts may include safe driving discounts, multi-vehicle discounts, loyalty discounts, and discounts for completing defensive driving courses or other professional driver training programs.

What factors should bus drivers consider when choosing car insurance?

Bus drivers should consider coverage options, the insurer’s financial strength, available discounts, customer service quality, and whether the policy is tailored to their specific needs.

How can bus drivers lower their car insurance premiums?

Bus drivers can lower premiums by maintaining a clean driving record, bundling policies, choosing a higher deductible, and completing defensive driving courses. Enter your ZIP code to compare rates and find the best insurance for your needs.

How can bus drivers determine if they are getting the best rates for their insurance?

Bus drivers should compare quotes from multiple providers, check coverage details, deductibles, and available discounts. Using online comparison tools and reviewing customer satisfaction ratings can help find the best rates.

For more details, read our article titled “Best Safe Driver Car Insurance Discounts.”

What should bus drivers look for in customer service when selecting the best car insurance?

Look for insurers with responsive claims handling, 24/7 customer support, and access to local agents for personalized assistance. High customer satisfaction ratings are also important.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.